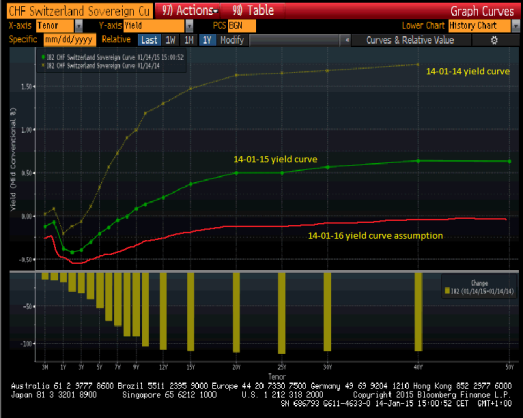

This morning I got myself analyzing the Swiss yield curve and I was stunned with the yield movement from the last 12 months. I started wondering what will this curve be like in the next 12 months, so drew a red line on the graph that simulates how low can yields reach if they continue this same insane trend.

TAKE AWAYS:

1) The Swiss investors have to go as far out as 8 years maturity to see a positive return

2) The 2 year yield around – 0.45% is the lowest yield EVER recorded

3) Today’s yield curve is the lowest curve the world has EVER seen (across any maturity)

4) If yields evolved the next 12 months as they did the last 12 months, the Swiss government may get paid to borrow for up to 40 years

Does this world make sense to you? Well, yes and no. No because if someone had told me 5 years ago that government bond yields would be where they are, I’d have thought “impossible”. I find amazing how markets seem to be sedated into believing this is just the new normal. I mean, is it normal to lend 100 CHF to the Swiss government today and receive 99.55 in 2017? I don’t think so. On the other hand this does make sense as it’s the only way to keep today’s broken system alive. I can only see 3 ways to get us out of this mess. One is Growth and that one seems out of reach – even the IMF recently dropped their projections for the world’s GDP growth to a mere 3%. Second is Inflation, but central banks are failing to achieve this – we are in a structural deleveraging process and this will probably last for another 1-2 years (at least). All the money printed is staying in the bond/equity/RE markets, it’s not filtering through the economy. (not to mention the velocity is money which is also dropping fast). So I can’t see inflation being the rescuer.. So negative rates seem to be the only way out for bankrupt governments to ever be able to pay back their monstruous debts – borrow at negative rates, essentially getting paid to borrow. Can you imagine lending 100 EUR today to the Portuguese, Spanish, Italian governments and receiving 99.50 in 2020? I’m afraid that’s where we are heading to – paying bankrupt governments to keep our money. This will not end well!!

Bom artigo.

Relativamente ao dinheiro nao estar a entrar na economia: observo, por um lado, que os mortgage rates em Portugal e Espanha estao a niveis que eu consideraria normais (spreads de 1.75 – 2.25pc, comparado com 4.75+ ha cerca de ano e meio); por outro, li hoje no jornal que o custo do credito as PMEs Portuguesas esta a niveis baixos e que nao eram verificados ha pouco mais de cinco anos atras (all-in cost para PMEs abaixo de 5pc anual). Embora nao queira defender que a economia esteja sã, o de cima podera ajudar a contribuir a uma normalizacao do consumo e investimento privado.

Se possivel, num proximo “post”, gostaria de saber a tua opiniao sobre o “above”, possivel impacto em subida da inflacao, etc.

Abraço!

LikeLike

Sim e verdade, mas este yield debasement que vemos faz com que haja um search of yield que leva fundos a investir em PT/SP, etc que de outro modo não investiria… As RMBS portuguesas estão a paga pouco mais que as UK RMBS – e sabes que isto e um dos grandes funding tools dos bancos para os empréstimos bancários. Alias, ainda ontem vimos uma procura de 2/3x superior a oferta para PGB’s de longo prazo. O dinheiro esta de novo a entrar aqui, mas não pelos melhores motivos .. simplesmente porque tem que ir para onde ha yield. Eu referia-me mais que o dinheiro tem servido mais para inflacionar as bolhas em RE/Equity/Bond e não tanto para as pessoas que mais precisam (se bem que as suas mortgages ficaram como dizes mais baratas). Mas as vezes pergunto-me se não seria melhor o helicopter QE para que chegasse realmente as pessoas de forma mais directa. Anyway, isso e outro assunto. A ver se escrevo 1 artigo por semana e vamos discutindo

LikeLike